Introduction to PROM validation

Data analysis crash course

- today: intro (data set, notation, ..), consistency, reliability (Cronbachs \(\alpha\)), invariance (DIF), local dependence, criterion validity

- also today: CFA

- after today: video lectures (examples in SAS and R), exercises on Absalon, ask question by e-mail to

kach@sund.ku.dk - next time: Q & A, work on the exam together

Intro

- data set (Exercise Adherence Rating Scale; EARS)

- path diagrams

Exercise Adherence Rating Scale (EARS)

measuring adherence to prescribed home exercise

FILENAME preg URL "http://publicifsv.sund.ku.dk/~kach/scaleval/EARS.csv";

PROC IMPORT FILE=preg OUT=SASUSER.EARS DBMS=csv REPLACE;

GETNAMES=YES;

DELIMITER=';';

RUN;https://www.sciencedirect.com/science/article/pii/S0031940616304801

Exercise Adherence Rating Scale (EARS)

measuring adherence to prescribed home exercise

https://www.sciencedirect.com/science/article/pii/S0031940616304801

Notation

Association between the variables \(A\) and \(B\) - and we believe that \(A\) causes \(B\). We put boxes around observed (manifest) variables

Notation

We put circles around unobserved (latent) variables. Will use \(\Theta\) or \(\theta\) (greek letter “theta”) to indicate latent variables.

Exercise Adherence Rating Scale (EARS)

Latent (unobservable) variable \(\Theta\), items \((X_i)_{i\in I}\), categorical exogenous variables \(Y\) (gender, age group)

SAS macro %itemmarg.sas()

FILENAME im URL 'https://raw.githubusercontent.com/KarlBangChristensen/itemmarg/master/itemmarg.sas';

%include im;

%ITEMMARG(DATA=SASUSER.EARS, ITEMS=item1-item6);SAS macro %itemmarg.sas()

BARplot R function

Install package (only do this once)

load package and plot

BARplot R function

Consistency

items positively correlated because they all measure \(\theta\)

positive association with sum score (proxy for \(\theta\))

many different correlations exist

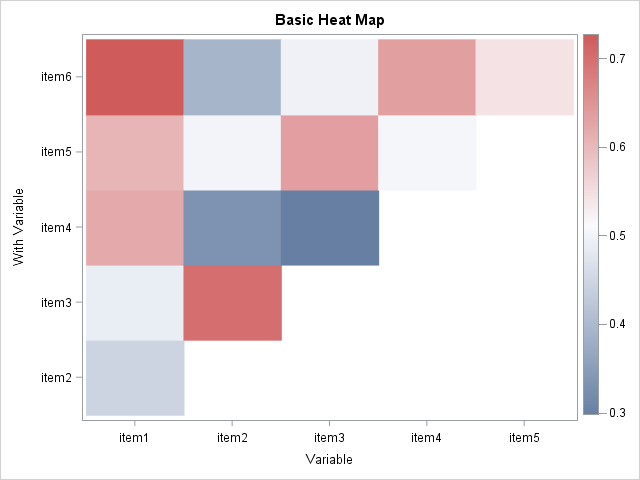

Polychoric correlation

Metsämuuronen, Front. Appl. Math. Stat., Sec. Statistics and Probability, Volume 8 - 2022 https://doi.org/10.3389/fams.2022.914932, Figure 1.

Inter-item correlations, SAS

| Polychoric Correlations | ||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | With Variable | N | Correlation | Wald Test | LR Test | |||

|

Standard Error |

Chi-Square | Pr > ChiSq | Chi-Square | Pr > ChiSq | ||||

| item1 | item2 | 192 | 0.44618 | 0.08031 | 30.8664 | <.0001 | 23.0330 | <.0001 |

Inter-item correlations, R

Polychoric Correlation, ML est. = 0.4464 (0.0812)

Test of bivariate normality: Chisquare = 43.66, df = 15, p = 0.0001241

Row Thresholds

Threshold Std.Err.

1 -2.128 0.23080

2 -1.999 0.20420

3 -1.337 0.12550

4 -0.460 0.09386

Column Thresholds

Threshold Std.Err.

1 -0.9340 0.10560

2 -0.3552 0.09233

3 0.3530 0.09256

4 0.3668 0.09275Inter-item correlations

Theoretical model

what we observe

Inter-item correlations, SAS

filename PMH URL "https://raw.githubusercontent.com/KarlBangChristensen/PolyHeatMap/master/PolyHeatMap.sas";

%include PMH;

%PolyHeatMap(dat=SASUSER.EARS, var=item1-item6);Inter-item correlations, SAS

Inter-item correlations, R

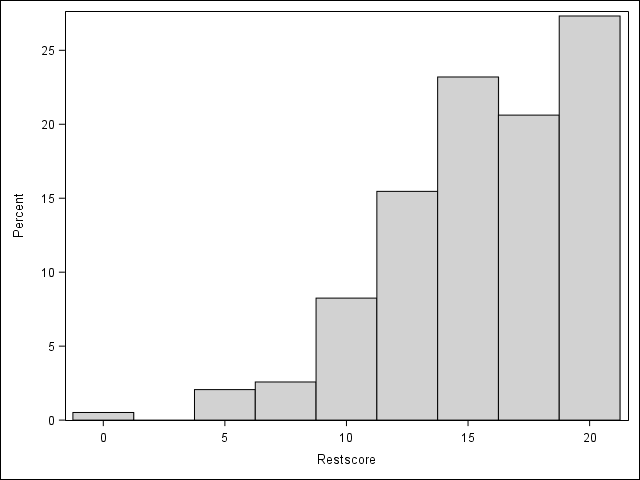

Total score

DATA WORK.EARS;

SET SASUSER.EARS;

score=SUM(OF item1-item6);

RUN;

PROC SGPLOT DATA=WORK.EARS;

HISTOGRAM score;

DENSITY score / TYPE=KERNEL;

RUN;Add item-total correlations, SAS

FILENAME st URL 'https://raw.githubusercontent.com/KarlBangChristensen/scaletest/master/scaletest.sas';

%INCLUDE st;

data WORK.new(where=(nm=0));

set SASUSER.EARS;

nm=nmiss(of item1-item6);

run;

%scaletest(data=WORK.new, ncat=5, items=item1-item6, type=SPEARMAN);Add item-total correlations, SAS

| name | mean | SD | _min | _max | floor | ceiling | Item | total |

|---|---|---|---|---|---|---|---|---|

| item1 | 3.55 | 0.78 | 0.36 | 0.61 | 1.6 | 67.4 | item1 | 0.65 |

| item2 | 2.17 | 1.51 | 0.26 | 0.60 | 17.5 | 35.1 | item2 | 0.76 |

| item3 | 1.96 | 1.51 | 0.22 | 0.60 | 21.5 | 29.2 | item3 | 0.79 |

| item4 | 3.60 | 0.76 | 0.22 | 0.50 | 1.0 | 72.8 | item4 | 0.53 |

| item5 | 3.20 | 1.36 | 0.36 | 0.46 | 9.8 | 70.6 | item5 | 0.72 |

| item6 | 3.49 | 0.93 | 0.32 | 0.61 | 3.6 | . | item6 | 0.66 |

Add item-total correlations, R

library(devtools)

gh <- "https://raw.githubusercontent.com/KarlBangChristensen/scaletest/master/scaletest.R"

source_url(gh)

scaletest(data = items, min_item_score = 0, max_item_score = 4) mean sd floor ceiling min max item_score_corr

item1 3.549223 0.7765522 1.554404 67.35751 0.3015623 0.4983621 0.6502836

item2 2.170103 1.5088454 17.525773 35.05155 0.2316051 0.5982678 0.7306689

item3 1.958974 1.5054400 21.538462 29.23077 0.2075063 0.5982678 0.7791156

item4 3.600000 0.7557341 1.025641 72.82051 0.2075063 0.4315206 0.5486745

item5 3.195876 1.3553897 9.793814 70.61856 0.3371068 0.4623874 0.7403411

item6 3.487179 0.9325664 3.589744 68.71795 0.2316051 0.4983621 0.6199170

raw_corr

item1 0.5393439

item2 0.5240605

item3 0.5987229

item4 0.4252349

item5 0.5650794

item6 0.4784750Visualizing item-total correlation

ods graphics on;

ods html5 style=htmlblue;

options nonotes;

DATA WORK.EARS;

SET SASUSER.EARS;

score=SUM(OF item1-item6);

RUN;

PROC RANK data=WORK.EARS out=WORK.grouped groups=5;

VAR score;

RANKS scoregroup;

RUN;

PROC MEANS DATA=WORK.grouped;

VAR item1;

CLASS scoregroup;

OUTPUT OUT=item1means MEAN=m LCLM=l UCLM=u;

RUN;

PROC SGPLOT DATA=WORK.item1means;

BAND X=scoregroup LOWER=l UPPER=u / LEGENDLABEL='95% CI';

SERIES X=scoregroup Y=m;

LABEL m='Mean score on anxiety item';

RUN;| Analysis Variable : item1 | ||||||

|---|---|---|---|---|---|---|

| Rank for Variable score | N Obs | N | Mean | Std Dev | Minimum | Maximum |

| 0 | 38 | 36 | 2.8333333 | 1.1084094 | 0 | 4.0000000 |

| 1 | 41 | 41 | 3.1951220 | 0.7489831 | 1.0000000 | 4.0000000 |

| 2 | 29 | 29 | 3.6551724 | 0.4837253 | 3.0000000 | 4.0000000 |

| 3 | 46 | 46 | 3.9565217 | 0.2948839 | 2.0000000 | 4.0000000 |

| 4 | 41 | 41 | 4.0000000 | 0 | 4.0000000 | 4.0000000 |

Reliability

\(\alpha\) is a measure of

- consistency: inter-item correlations positive ?

- reliability: how precisely does the score measure \(\theta\) ?

compute \(\alpha\), SAS

PROC CORR DATA=SASUSER.EARS ALPHA NOMISS;

VAR item1-item6;

ODS SELECT "Cronbach Coefficient Alpha";

RUN;\(\alpha\), SAS

| Cronbach Coefficient Alpha | |

|---|---|

| Variables | Alpha |

| Raw | 0.755560 |

| Standardized | 0.774217 |

compute \(\alpha\), R

only do this once

install.packages("multilevel", repos="http://cran.rstudio.com/")compute \(\alpha\)

\(\alpha\)

is a lower boundary of the reliability

\(\alpha\)

is a lower boundary of the reliability, but only if items are unidimensional and there is no local dependence.

\(\alpha\)

is a lower boundary of the reliability, but only if items are unidimensional and there is no local dependence. It is not a measure of validity.

Invariance (no differential item functioning; DIF)

Notation

\[ X_i\perp Y|\Theta \]

the item response does not depend directly on a covariate \(Y\)

Covariate

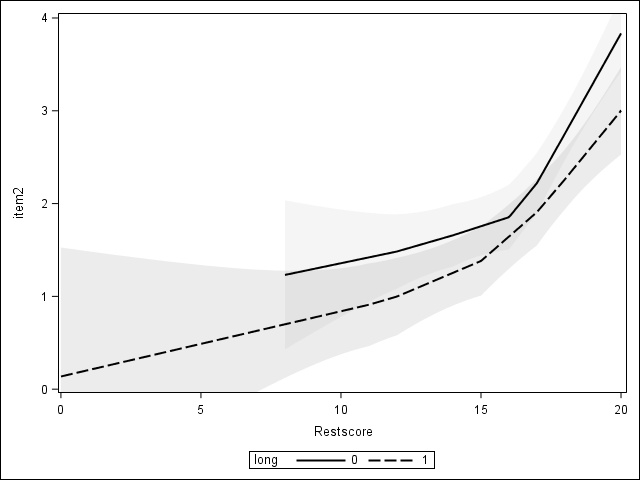

the covariate long groups respondents in two groups.

- an association between

longand an item should only occur because of an association betweenlongand the latent variable.

Correlation ..

.. measures the degree of association between two random variables \(X\) and \(Y\)

Partial correlation

.. measures the degree of association between \(X\) and \(Y\), with the of a controlling variable \(Y\) removed

\[ \hat{\rho}_{XY\cdot\mathbf{Z}}=\frac{N\sum_{i=1}^N r_{X,i}r_{Y,i}-\sum_{i=1}^N r_{X,i}\sum_{i=1}^N r_{Y,i}} {\sqrt{N\sum_{i=1}^N r_{X,i}^2-\left(\sum_{i=1}^N r_{X,i}\right)^2}~\sqrt{N\sum_{i=1}^N r_{Y,i}^2-\left(\sum_{i=1}^N r_{Y,i}\right)^2}} \]

Can be used to explain (some of) the correlation between \(X\) and \(Y\). We can test if \(Z\) explains all of the correlation between \(X\) and \(Y\)

Correlation and partial correlation

Correlation and partial correlation

Correlation

| Spearman Correlation Statistics (Fisher's z Transformation) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Variable | With Variable | N | Sample Correlation | Fisher's z | Bias Adjustment | Correlation Estimate | 95% Confidence Limits |

p Value for H0:Rho=0 |

|

| item2 | long | 162 | -0.19229 | -0.19472 | -0.0005972 | -0.19172 | -0.335979 | -0.038663 | 0.0141 |

this is not evidence that something is wrong with the item

Partial correlation

| Spearman Partial Correlation Statistics (Fisher's z Transformation) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variable | With Variable | N | N Partialled | Sample Correlation | Fisher's z | Bias Adjustment | Correlation Estimate | 95% Confidence Limits |

p Value for H0: Partial Rho=0 |

|

| item2 | long | 162 | 1 | -0.17629 | -0.17815 | -0.0005509 | -0.17575 | -0.321684 | -0.021668 | 0.0251 |

members of the two groups with the same total score differ significantly so there is a problem with the item.

DIF can be visualized

DIF can be visualized

DIF can be visualized

DIF can be visualized

Looking for DIF

Test DIF using

- Mantel-Haenszel

- Partial correlation

- Logistic regression

Local dependence

Four testable assumption - three ((i), (ii), and (iii)) are intuitive. However (iv) local independence is a technical assumption and it is not as intuitive.

(iv) local independence

trick

think of \(X_4\) as an exogenous variable and handle this as a DIF problem.

- score is \(R_4=X_1+X_2+X_3\)

- we test conditional independence \(X_3\perp X_4|R_4\)

trick

a similar argument where \(X_3\) and \(X_4\) switch places

- compute (rest) score \(R_3=X_1+X_2+X_4\)

- test \(X_3\perp X_4|R_3\)

Tjur (1982). Scandinavian Journal of Statistics, 9, 23–30. http://www.jstor.org/stable/4615850

SAS macro

FILENAME TJUR URL 'http://192.38.117.59/~kach/macro/tjur.sas';

%INCLUDE TJUR;

DATA WORK.nm;

SET SASUSER.EARS;

IF NMISS(OF item1-item6)>0 THEN DELETE;

RUN;

%TJUR(DATA=WORK.nm, ITEMS=item1-item6);

PROC PRINT DATA=TJUR NOOBS;

WHERE _TYPE_='CORR';

VAR _name_ item1-item6;

FORMAT item1-item6 8.2;

RUN;Local dependence in EARS data

15 item pairs (two partial correlations for each of them).

let’s focus

| item1 | item2 | item3 | item4 | item5 | item6 | |

|---|---|---|---|---|---|---|

| item1 | 1.00 | |||||

| item2 | 1.00 | 0.29 | ||||

| item3 | 0.35 | 1.00 | ||||

| item4 | 1.00 | |||||

| item5 | 1.00 | |||||

| item6 | 0.01 |

Using R

Read data and calculate rest scores

EARS <- read.csv(url("http://publicifsv.sund.ku.dk/~kach/scaleval/EARS.csv"), sep=';')

items <- EARS[,c("item1","item2","item3","item4","item5","item6")]

nm <- items[complete.cases(items),]

nm$rscore1 <- nm$item2 + nm$item3 + nm$item4 + nm$item5 + nm$item6

nm$rscore2 <- nm$item1 + nm$item3 + nm$item4 + nm$item5 + nm$item6

nm$rscore3 <- nm$item1 + nm$item2 + nm$item4 + nm$item5 + nm$item6Using R

calculate (some of) the partial correlations

[1] 0.35[1] 0.29Criterion validity

- latent variable \(\Theta\)

score=item1+ … +item6indirect measure of \(\Theta\)- for any variable \(Z\) where \[\textrm{corr}(Z,\Theta)>0\] we expect \(\textrm{corr}(Z,\)

score\()>0\) - This can be tested

Confirmatory factor analysis (CFA) ..

.. is essentially a statistical model that incorporates all the assumptions we have discussed.

- Testing the fit of a CFA model to your data will tell you if the instrument is valid

Two types of factor analysis

Exploratory factor analysis (EFA):

Data is explored to determine the number of underlying factors. Prior knowledge about data generating mechanisms is ignored. Will not be considered here.Confirmatory factor analysis (CFA): Based on prior knowledge a factor structure is postulated and tested against data.

Methods originally developed for continuous items and an assumption of multivariate normal distribution.

CFA model for EARS data

Statistical model for the joint distribution of all items and covariates

CFA model

Statistical model for the joint distribution of all items and covariates

- Allows inclusion of DIF and local dependence

- (Allows models with a multivariate latent variable)

- Builds on the normal distribution

CFA model

SAS procedure CALIS. Hatcher, 1996, doi:10.1080/10705519609540037

R package

lavaan. Rosseel, 2012. doi: 10.18637/jss.v048.i02. http://lavaan.ugent.becommercial software package Mplus is the gold standard.

CFA model for one factor

- Data on \(p\) items for subject \(i\)

- vector \(\boldsymbol{x}_i=(x_{i1},...,x_{ip})^t\).

- underlying variable \(\theta_i\).

- Model \[ \begin{array}{lcl} x_{i1}& = &\nu_1+\lambda_1 \theta_i + \epsilon_{i1}\\ &:\\ x_{ip} &= &\nu_p+\lambda_p \theta_i + \epsilon_{ip} \end{array} \]

- Latent variable and measurement errors follow normal distribution

- \(\theta_i \sim N(\alpha,\psi)\) independent of \(\epsilon_{ij} \sim N(0, \omega_j)\)

Parameters

- \(\lambda_j:\) factor loading,

- \(\omega_j:\) measurement error variance

CFA model in matrix form

\[ \boldsymbol{x}_i=\nu + \boldsymbol{\Lambda} \boldsymbol{\theta}_i + \boldsymbol{\epsilon}_i \] vectors \(\boldsymbol{\theta}_i\) and \(\boldsymbol{\epsilon}_i\) are independent,

\[ \boldsymbol{\theta}_i \sim N(\boldsymbol{\alpha},\boldsymbol{\Psi})\;\;\;\; \boldsymbol{\epsilon}_i\sim N(0,\boldsymbol{\Omega}) \] - \(\Omega\) diagonal matrix. - Error uncorrelated.

local indpendence

- \(\Omega\) is typically a diagonal matrix.

- Error terms are assumed to be uncorrelated.

- This is the assumption of local independence

- Latent variable is the only reason the items are correlated.

Path diagrams

- Boxes: observed variables

- Circles or ovals: latent variables

- One headed arrows: linear effects

- Two headed arrows: un-directional associations

Dimensionality

we only consider uni-dimensional CFA models, but CFA also works for multi-dimensional models.

if the CFA model fits the data we conclude that there is no evidence against the null hypothesis the the instrument is uni-dimensional

items are assumed to be continuous and error terms normally distributed

We are not very happy about the normality assumption

Model

\[ \begin{array}{lcl} x_{i1}& = &\nu_1+\lambda_1 \theta_i + \epsilon_{i1}\\ &:\\ x_{ip} &= &\nu_p+\lambda_p \theta_i + \epsilon_{ip} \end{array} \]

- \(\lambda_j:\) factor loading,

- \(V(\epsilon_{ip})=\omega_j:\) measurement error variance

- local dependence = correlated error terms

- local independence = uncorrelated error terms

Path diagram EARS data

- Boxes: observed variables

- Circles or ovals: latent variables

- One headed arrows: linear effects

- Two headed arrows: un-directional associations

local independence

Measurement errors \((\epsilon_1,\ldots,\epsilon_6)\) independent \[ \Omega= \begin{bmatrix} \sigma_1^2&0&0&0&0&0\\ 0&\sigma_2^2&0&0&0&0\\ 0&0&\sigma_3^2&0&0&0\\ 0&0&0&\sigma_4^2&0&0\\ 0&0&0&0&\sigma_5^2&0\\ 0&0&0&0&0&\sigma_6^2 \end{bmatrix} \]

Estimation

For identification we fix \(V(\Theta)=1\) this means that \[ \textrm{corr}(X_j,\Theta)=\lambda_j\;\;\;V(\epsilon_{j})=1-\lambda_j^2 \]

High \(\lambda\)-value \(\rightarrow\) item is precise.

- no test for item quality only assessed indirectly by inspecting the \(\lambda\)’s

CFA model induces structure in correlation

\[ \textrm{corr}_{\lambda}(X)= \left( \begin{array}{ccccc} 1 \\ \lambda_2\lambda_1 & 1 \\ \lambda_3\lambda_1 & \lambda_3\lambda_2 & 1& \\ \vdots&\vdots&\ddots&\ddots\\ \lambda_6\lambda_1 & \lambda_6\lambda_2 & \cdots & \lambda_6\lambda_5 & 1\\ \end{array}\right) \]

Estimate CFA model using PROC CALIS in SAS

PROC CALIS DATA=SASUSER.EARS;

LINEQS

item1 = lam1 * F + E1,

item2 = lam2 * F + E2,

item3 = lam3 * F + E3,

item4 = lam4 * F + E4,

item5 = lam5 * F + E5,

item6 = lam6 * F + E6;

STD

F = 1;

ODS SELECT Calis.StandardizedResults.LINEQSEqStd;

RUN;Output PROC CALIS in SAS

Covariance Structure Analysis: Maximum Likelihood Estimation

| Standardized Results for Linear Equations | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| item1 | = | 0.6582 | (**) | F | + | 1.0000 | E1 | ||

| item2 | = | 0.5952 | (**) | F | + | 1.0000 | E2 | ||

| item3 | = | 0.6578 | (**) | F | + | 1.0000 | E3 | ||

| item4 | = | 0.4931 | (**) | F | + | 1.0000 | E4 | ||

| item5 | = | 0.6430 | (**) | F | + | 1.0000 | E5 | ||

| item6 | = | 0.5733 | (**) | F | + | 1.0000 | E6 | ||

Estimate CFA model using lavaan in R

library(lavaan)

EARS <- read.csv(url("http://publicifsv.sund.ku.dk/~kach/scaleval/EARS.csv"), sep=';')

EARS.model.1 <- 'Theta =~ item1+item2+item3+item4+item5+item6'

fit <- cfa(EARS.model.1, data=EARS, likelihood='wishart')

standardizedsolution(fit)Output lavaan in R

lhs op rhs est.std se z pvalue ci.lower ci.upper

1 Theta =~ item1 0.658 0.054 12.161 0 0.552 0.764

2 Theta =~ item2 0.595 0.059 10.147 0 0.480 0.710

3 Theta =~ item3 0.658 0.054 12.150 0 0.552 0.764

4 Theta =~ item4 0.493 0.066 7.511 0 0.364 0.622

5 Theta =~ item5 0.643 0.055 11.647 0 0.535 0.751

6 Theta =~ item6 0.573 0.060 9.519 0 0.455 0.691

7 item1 ~~ item1 0.567 0.071 7.956 0 0.427 0.706

8 item2 ~~ item2 0.646 0.070 9.247 0 0.509 0.783

9 item3 ~~ item3 0.567 0.071 7.962 0 0.428 0.707

10 item4 ~~ item4 0.757 0.065 11.693 0 0.630 0.884

11 item5 ~~ item5 0.587 0.071 8.260 0 0.447 0.726

12 item6 ~~ item6 0.671 0.069 9.724 0 0.536 0.807

13 Theta ~~ Theta 1.000 0.000 NA NA 1.000 1.000Chi-squared test of model fit

The fit of the model is tested by comparing

- \(\left( \begin{array}{ccccc} 1 \\ \lambda_2\lambda_1 & 1 \\ \lambda_3\lambda_1 & \lambda_3\lambda_2 & 1& \\ \vdots&\vdots&\ddots&\ddots\\ \lambda_6\lambda_1 & \lambda_6\lambda_2 & \cdots & \lambda_6\lambda_5 & 1\\ \end{array}\right)\)

and

- \(\left( \begin{array}{cccc} 1 \\ \rho_{21} & 1 \\ \vdots & \ddots & \ddots \\ \rho_{51} & \cdots & \rho_{54} & 1 &\\ \rho_{61} & \cdots & \rho_{64} & \rho_{65} & 1\\ \end{array}\right)\)

Degrees of freedom

The unrestricted model has 21 parameters (6 variances and 15 correlations) and in the CFA model we are testing there are 12 parameters (6 \(\lambda\)’s and 6 \(\epsilon\)’s).

- Degrees of freedom: \(df=21-12=9\)

SAS

ods html5 style=htmlblue;

PROC CALIS DATA=SASUSER.EARS;

LINEQS

item1 = lam1 * F + E1,

item2 = lam2 * F + E2,

item3 = lam3 * F + E3,

item4 = lam4 * F + E4,

item5 = lam5 * F + E5,

item6 = lam6 * F + E6;

STD

F = 1;

FITINDEX NOINDEXTYPE ON(ONLY)=[NOBS CHISQ DF PROBCHI];

ODS SELECT "Fit Summary";

RUN;Covariance Structure Analysis: Maximum Likelihood Estimation

| Fit Summary | |

|---|---|

| Number of Observations | 191 |

| Chi-Square | 59.0301 |

| Chi-Square DF | 9 |

| Pr > Chi-Square | <.0001 |

R

library(lavaan)

EARS <- read.csv(url("http://publicifsv.sund.ku.dk/~kach/scaleval/EARS.csv"), sep=';')

EARS.model.1 <- 'Theta =~ item1+item2+item3+item4+item5+item6'

fit <- cfa(EARS.model.1, data=EARS, likelihood='wishart')

fitMeasures(fit, c("ntotal","chisq","df","p-value"))ntotal chisq df

191.00 59.03 9.00 Test logic is backward

Lower power increases the chance that you will retain the model.

The Root Mean Square Error Of Approximation (RMSEA)

- \(\mbox{RMSEA}=\sqrt{\frac{\chi^2-df}{df (N-1)}}\).

- If model is correct then \(\chi^2 \approx df\) and RMSEA is close to 0.

- If model is wrong \(\chi^2 > df\) and RMSEA is high.

- RMSEA is a measure of badness-of-fit

Root Mean Square Error Of Approximation

- There is no \(p\)-value in RMSEA.

- It is not clear what levels to expect if the model is correct.

- Often used cut-off value: RMSEA \(\leq 0.05\)

Model fit evaluation

- Both \(\chi^2\) and RMSEA measure over-all fit.

- Some parts of the model may be very wrong, even in models that pass the test.

- Test logic is backward: Lower power increases the chance that you will retain the model.

- Upper CI for RMSEA does not have this problem.

SAS

Covariance Structure Analysis: Maximum Likelihood Estimation

| Fit Summary | |

|---|---|

| Number of Observations | 191 |

| Chi-Square | 59.0301 |

| Chi-Square DF | 9 |

| Pr > Chi-Square | <.0001 |

| RMSEA Estimate | 0.1710 |

| RMSEA Lower 90% Confidence Limit | 0.1311 |

| RMSEA Upper 90% Confidence Limit | 0.2138 |

R

ntotal chisq df rmsea rmsea.ci.lower

191.000 59.030 9.000 0.171 0.131

rmsea.ci.upper

0.214 So in the EARS data set the test against the unrestricted model rejects the hypothesis:

- \(\chi^2\)=59.0, df= 12, p<0.0001.

- \(RMSEA\)=0.171 (95% CI 0.131 to 0.214)

Modification indices ..

.. measure how much better model-fit would become if a fixed parameter was set free to be estimated.

- If a parameter \(\beta\) fixed, e.g. \(\beta=0\), MI tests the hypothesis \(H_0:\beta=0\) against the alternative \(H_a:\beta\ne0\).

- under \(H_0\) the distribution of \(MI\) is \(\chi^2_1\)

- if \(MI\) is high the corresponding model restriction is not supported by the data.

Relax assumption in model

\[ \begin{bmatrix} x_{i1}\\ \vdots\\ x_{i6} \end{bmatrix} = \begin{bmatrix} \lambda_{1}\\ \vdots\\ \lambda_{6}\\ \end{bmatrix} \cdot \theta_i + \begin{bmatrix} \epsilon_{i1}\\ \vdots\\ \epsilon_{i6}\\ \end{bmatrix} \]

by allowing correlation between error terms between \(\epsilon_k\) and \(\epsilon_l\):

\[ cov(\epsilon_k, \epsilon_l) \ne 0 \] For example

\[ \Omega= \begin{bmatrix} \sigma_1^2&0&0&0&0&0\\ 0&\sigma_2^2&0&0&\boldsymbol{\rho}&0\\ 0&0&\sigma_3^2&0&0&0\\ 0&0&0&\sigma_4^2&0&0\\ 0&\boldsymbol{\rho}&0&0&\sigma_5^2&0\\ 0&0&0&0&0&\sigma_6^2\\ \end{bmatrix} \]

- for fixed value of latent variable the items \(y_k\) and \(y_l\) are correlated.

- There are 15 different item pairs and we can add the pair with the highest MI (we prefer only to do this if makes subject matter sense).

Let’s compute and print (some of the) MI’s using R

library(lavaan)

EARS <- read.csv(url("http://publicifsv.sund.ku.dk/~kach/scaleval/EARS.csv"), sep=';')

EARS.model.1 <-

'Theta =~ item1+item2+item3+item4+item5+item6'

fit <- cfa(EARS.model.1, data=EARS, likelihood='wishart')

MI <- modificationindices(fit)

MI[c(1:10),] lhs op rhs mi epc sepc.lv sepc.all sepc.nox

14 item1 ~~ item2 6.612 -0.178 -0.178 -0.250 -0.250

15 item1 ~~ item3 10.013 -0.222 -0.222 -0.333 -0.333

16 item1 ~~ item4 4.092 0.069 0.069 0.182 0.182

17 item1 ~~ item5 0.638 0.049 0.049 0.082 0.082

18 item1 ~~ item6 13.047 0.153 0.153 0.343 0.343

19 item2 ~~ item3 39.954 0.848 0.848 0.614 0.614

20 item2 ~~ item4 1.236 -0.074 -0.074 -0.095 -0.095

21 item2 ~~ item5 0.186 -0.051 -0.051 -0.041 -0.041

22 item2 ~~ item6 8.255 -0.237 -0.237 -0.256 -0.256

23 item3 ~~ item4 10.912 -0.218 -0.218 -0.296 -0.296Adding a parameter using SAS

ods html5 style=htmlblue;

PROC CALIS DATA=SASUSER.EARS;

LINEQS

item1 = lam1 * F + E1,

item2 = lam2 * F + E2,

item3 = lam3 * F + E3,

item4 = lam4 * F + E4,

item5 = lam5 * F + E5,

item6 = lam6 * F + E6;

STD

F = 1;

COV E2 E3=rho;

FITINDEX NOINDEXTYPE ON(ONLY)=[NOBS CHISQ DF PROBCHI RMSEA RMSEA_LL RMSEA_UL];

ODS SELECT "Fit Summary";

RUN;Covariance Structure Analysis: Maximum Likelihood Estimation

| Fit Summary | |

|---|---|

| Number of Observations | 191 |

| Chi-Square | 20.8272 |

| Chi-Square DF | 8 |

| Pr > Chi-Square | 0.0076 |

| RMSEA Estimate | 0.0919 |

| RMSEA Lower 90% Confidence Limit | 0.0442 |

| RMSEA Upper 90% Confidence Limit | 0.1412 |

add correlated error terms

\[ \Omega= \begin{bmatrix} \sigma_1^2&0&0&0&0&0\\ 0&\sigma_2^2&\boldsymbol{\rho}&0&0&0\\ 0&\boldsymbol{\rho}&\sigma_3^2&0&0&0\\ 0&0&0&\sigma_4^2&0&0\\ 0&0&0&0&\sigma_5^2&0\\ 0&0&0&0&0&\sigma_6^2\\ \end{bmatrix} \]

Adding a parameter using R

library(lavaan)

EARS <- read.csv(url("http://publicifsv.sund.ku.dk/~kach/scaleval/EARS.csv"), sep=';')

EARS.model.2 <-

'Theta =~ item1+item2+item3+item4+item5+item6

item2 ~~ item3'

fit <- cfa(EARS.model.2, data=EARS, likelihood='wishart')

fitMeasures(fit, c("ntotal","chisq","df","p-value","rmsea","rmsea.ci.lower","rmsea.ci.upper")) ntotal chisq df rmsea rmsea.ci.lower

191.000 20.827 8.000 0.092 0.044

rmsea.ci.upper

0.141 Summary

- Model fit is improved by adding correlated error term,

- but still the fit is not not good.

- Note \(df=8\) (before it was \(9\)).

- We can add more correlated error terms

evaluating DIF using CFA ..

.. is done using multiple groups CFA (MG-CFA)

two groups in the EARS data

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

omit missing

two groups in the EARS data

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||

CFA in one sub group

ods html5 style=htmlblue;

PROC CALIS DATA=SASUSER.EARS_NM PLOT=PATHDIAGRAM mod;

WHERE long=0;

LINEQS

item1 = lam1 * F + E1,

item2 = lam2 * F + E2,

item3 = lam3 * F + E3,

item4 = lam4 * F + E4,

item5 = lam5 * F + E5,

item6 = lam6 * F + E6;

STD

F = 1;

PATHDIAGRAM DIAGRAM=[STANDARD] FITINDEX=[NOBS CHISQ DF PROBCHI];

ODS SELECT 'Standardized';

RUN;Covariance Structure Analysis: Maximum Likelihood Estimation

CFA in the other sub group

ods html5 style=htmlblue;

PROC CALIS DATA=SASUSER.EARS_NM PLOT=PATHDIAGRAM mod;

WHERE long=1;

LINEQS

item1 = lam1 * F + E1,

item2 = lam2 * F + E2,

item3 = lam3 * F + E3,

item4 = lam4 * F + E4,

item5 = lam5 * F + E5,

item6 = lam6 * F + E6;

STD

F = 1;

PATHDIAGRAM DIAGRAM=[STANDARD] FITINDEX=[NOBS CHISQ DF PROBCHI];

ODS SELECT 'Standardized';

RUN;Covariance Structure Analysis: Maximum Likelihood Estimation

Let’s expand our simple CFA

let \(\boldsymbol{X}^{(1)}\) and \(\boldsymbol{X}^{(2)}\) denote data the two groups. configural invariance.

\[ \boldsymbol{X}^{(1)}=\boldsymbol{\nu}^{(1)}+\boldsymbol{\lambda}^{(1)}\cdot\theta+\boldsymbol{\epsilon}\;\;\;\;\boldsymbol{\epsilon}\sim N(0,\Omega^{(1)}) \] \[ \boldsymbol{X}^{(2)}=\boldsymbol{\nu}^{(2)}+\boldsymbol{\lambda}^{(2)}\cdot\theta+\boldsymbol{\epsilon}\;\;\;\;\boldsymbol{\epsilon}\sim N(0,\Omega^{(2)}) \]

Later we can impose one or more of the different restrictions \[ \boldsymbol{\nu}^{(1)}=\boldsymbol{\nu}^{(2)}\;\;\;\;\boldsymbol{\lambda}^{(1)}=\boldsymbol{\lambda}^{(2)}\;\;\;\;\Omega^{(1)}=\Omega^{(2)} \]

Configural invariance

ods html5 style=htmlblue;

PROC CALIS PLOT=PATHDIAGRAM mod;

group 1 / data=SASUSER.EARS_nm(where=(long=1));

group 2 / data=SASUSER.EARS_nm(where=(long=0));

MODEL 1 / GROUP=1;

LINEQS

item1 = nu1_1*Intercept + lam1_1*F + E1,

item2 = nu2_1*Intercept + lam2_1*F + E2,

item3 = nu3_1*Intercept + lam3_1*F + E3,

item4 = nu4_1*Intercept + lam4_1*F + E4,

item5 = nu5_1*Intercept + lam5_1*F + E5,

item6 = nu6_1*Intercept + lam6_1*F + E6;

MEAN F=0;

STD

E1 = eps1_1,

E2 = eps2_1,

E3 = eps3_1,

E4 = eps4_1,

E5 = eps5_1,

E6 = eps6_1,

F=1;

MODEL 2 / GROUP=2;

LINEQS

item1 = nu1_2*Intercept + lam1_2*F + E1,

item2 = nu2_2*Intercept + lam2_2*F + E2,

item3 = nu3_2*Intercept + lam3_2*F + E3,

item4 = nu4_2*Intercept + lam4_2*F + E4,

item5 = nu5_2*Intercept + lam5_2*F + E5,

item6 = nu6_2*Intercept + lam6_2*F + E6;

MEAN F=0;

STD

E1 = eps1_2,

E2 = eps2_2,

E3 = eps3_2,

E4 = eps4_2,

E5 = eps5_2,

E6 = eps6_2,

F=1;

FITINDEX ON(ONLY) = [NOBS CHISQ DF PROBCHI];

ODS SELECT "Fit Summary" ML.Model1.LINEQSEq ML.Model2.LINEQSEq;

RUN;Mean and Covariance Structures: Maximum Likelihood Estimation

| Fit Summary | ||

|---|---|---|

| Modeling Info | Number of Observations | 161 |

| Absolute Index | Chi-Square | 59.5643 |

| Chi-Square DF | 18 | |

| Pr > Chi-Square | <.0001 | |

Mean and Covariance Structures: Maximum Likelihood Estimation

| Model 1. Linear Equations | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| item1 | = | 3.5211 | (**) | Intercept | + | 0.6313 | (**) | F | + | 1.0000 | E1 | ||

| item2 | = | 1.8310 | (**) | Intercept | + | 0.8764 | (**) | F | + | 1.0000 | E2 | ||

| item3 | = | 1.9577 | (**) | Intercept | + | 1.0125 | (**) | F | + | 1.0000 | E3 | ||

| item4 | = | 3.6197 | (**) | Intercept | + | 0.4819 | (**) | F | + | 1.0000 | E4 | ||

| item5 | = | 3.1268 | (**) | Intercept | + | 1.0309 | (**) | F | + | 1.0000 | E5 | ||

| item6 | = | 3.4930 | (**) | Intercept | + | 0.6510 | (**) | F | + | 1.0000 | E6 | ||

| Model 2. Linear Equations | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| item1 | = | 3.5667 | (**) | Intercept | + | 0.3907 | (**) | F | + | 1.0000 | E1 | ||

| item2 | = | 2.4333 | (**) | Intercept | + | 1.1762 | (**) | F | + | 1.0000 | E2 | ||

| item3 | = | 2.0889 | (**) | Intercept | + | 1.2299 | (**) | F | + | 1.0000 | E3 | ||

| item4 | = | 3.6444 | (**) | Intercept | + | 0.2105 | (**) | F | + | 1.0000 | E4 | ||

| item5 | = | 3.3444 | (**) | Intercept | + | 0.6100 | (**) | F | + | 1.0000 | E5 | ||

| item6 | = | 3.6111 | (**) | Intercept | + | 0.3292 | (**) | F | + | 1.0000 | E6 | ||

Configural invariance

Mean and Covariance Structures: Maximum Likelihood Estimation

| Fit Summary | ||

|---|---|---|

| Modeling Info | Number of Observations | 161 |

| Absolute Index | Chi-Square | 59.5643 |

| Chi-Square DF | 18 | |

| Pr > Chi-Square | <.0001 | |

Mean and Covariance Structures: Maximum Likelihood Estimation

| Model 1. Linear Equations | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| item1 | = | 3.5211 | (**) | Intercept | + | 0.6313 | (**) | F | + | 1.0000 | E1 | ||

| item2 | = | 1.8310 | (**) | Intercept | + | 0.8764 | (**) | F | + | 1.0000 | E2 | ||

| item3 | = | 1.9577 | (**) | Intercept | + | 1.0125 | (**) | F | + | 1.0000 | E3 | ||

| item4 | = | 3.6197 | (**) | Intercept | + | 0.4819 | (**) | F | + | 1.0000 | E4 | ||

| item5 | = | 3.1268 | (**) | Intercept | + | 1.0309 | (**) | F | + | 1.0000 | E5 | ||

| item6 | = | 3.4930 | (**) | Intercept | + | 0.6510 | (**) | F | + | 1.0000 | E6 | ||

| Model 2. Linear Equations | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| item1 | = | 3.5667 | (**) | Intercept | + | 0.3907 | (**) | F | + | 1.0000 | E1 | ||

| item2 | = | 2.4333 | (**) | Intercept | + | 1.1762 | (**) | F | + | 1.0000 | E2 | ||

| item3 | = | 2.0889 | (**) | Intercept | + | 1.2299 | (**) | F | + | 1.0000 | E3 | ||

| item4 | = | 3.6444 | (**) | Intercept | + | 0.2105 | (**) | F | + | 1.0000 | E4 | ||

| item5 | = | 3.3444 | (**) | Intercept | + | 0.6100 | (**) | F | + | 1.0000 | E5 | ||

| item6 | = | 3.6111 | (**) | Intercept | + | 0.3292 | (**) | F | + | 1.0000 | E6 | ||

This makes sense

- \(9+9=18\) degrees of freedom

- \(\chi^2=31.83+27.72=59.6\)

Evidence of DIF from earlier

| Spearman Partial Correlation Statistics (Fisher's z Transformation) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variable | With Variable | N | N Partialled | Sample Correlation | Fisher's z | Bias Adjustment | Correlation Estimate | 95% Confidence Limits |

p Value for H0: Partial Rho=0 |

|

| item2 | long | 162 | 1 | -0.17629 | -0.17815 | -0.0005509 | -0.17575 | -0.321684 | -0.021668 | 0.0251 |

members of the two groups with the same total score differ significantly so there is a problem with the item.

Let’s include this - model with partial invariance

Mean and Covariance Structures: Maximum Likelihood Estimation

| Model 1. Linear Equations | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| item1 | = | 3.5542 | (**) | Intercept | + | 0.6060 | (**) | F | + | 1.0000 | E1 | ||

| item2 | = | 1.8982 | (**) | Intercept | + | 0.9224 | (**) | F | + | 1.0000 | E2 | ||

| item3 | = | 2.0479 | (**) | Intercept | + | 1.2101 | (**) | F | + | 1.0000 | E3 | ||

| item4 | = | 3.6393 | (**) | Intercept | + | 0.4160 | (**) | F | + | 1.0000 | E4 | ||

| item5 | = | 3.2572 | (**) | Intercept | + | 1.0051 | (**) | F | + | 1.0000 | E5 | ||

| item6 | = | 3.5720 | (**) | Intercept | + | 0.5847 | (**) | F | + | 1.0000 | E6 | ||

| Model 2. Linear Equations | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| item1 | = | 3.5542 | (**) | Intercept | + | 0.6060 | (**) | F | + | 1.0000 | E1 | ||

| item2 | = | 2.3888 | (**) | Intercept | + | 1.3663 | (**) | F | + | 1.0000 | E2 | ||

| item3 | = | 2.0479 | (**) | Intercept | + | 1.2101 | (**) | F | + | 1.0000 | E3 | ||

| item4 | = | 3.6393 | (**) | Intercept | + | 0.4160 | (**) | F | + | 1.0000 | E4 | ||

| item5 | = | 3.2572 | (**) | Intercept | + | 1.0051 | (**) | F | + | 1.0000 | E5 | ||

| item6 | = | 3.5720 | (**) | Intercept | + | 0.5847 | (**) | F | + | 1.0000 | E6 | ||

Let’s include this - model with partial invariance

Mean and Covariance Structures: Maximum Likelihood Estimation

| Fit Summary | ||

|---|---|---|

| Modeling Info | Number of Observations | 161 |

| Absolute Index | Chi-Square | 69.1437 |

| Chi-Square DF | 27 | |

| Pr > Chi-Square | <.0001 | |

Should be compared to this model (scalar invariance)

Mean and Covariance Structures: Maximum Likelihood Estimation

| Fit Summary | ||

|---|---|---|

| Modeling Info | Number of Observations | 161 |

| Absolute Index | Chi-Square | 75.4021 |

| Chi-Square DF | 28 | |

| Pr > Chi-Square | <.0001 | |